In the complex world of industrial asset valuation, accurately determining their true value extends beyond numerical calculations. It’s an intricate dance of expertise, market sensitivity, and understanding the unique nuances of your specific industry. It’s an intricate dance of expertise, market sensitivity, and understanding the unique nuances of your specific industry. When navigating this complex terrain, you need a partner who possesses not just technical prowess, but also a proven track record of navigating the ever-shifting industrial landscape. Enter Reliant Surveyors, your trusted compass for industrial valuation excellence.

Why do we need to do Industrial Asset valuation?

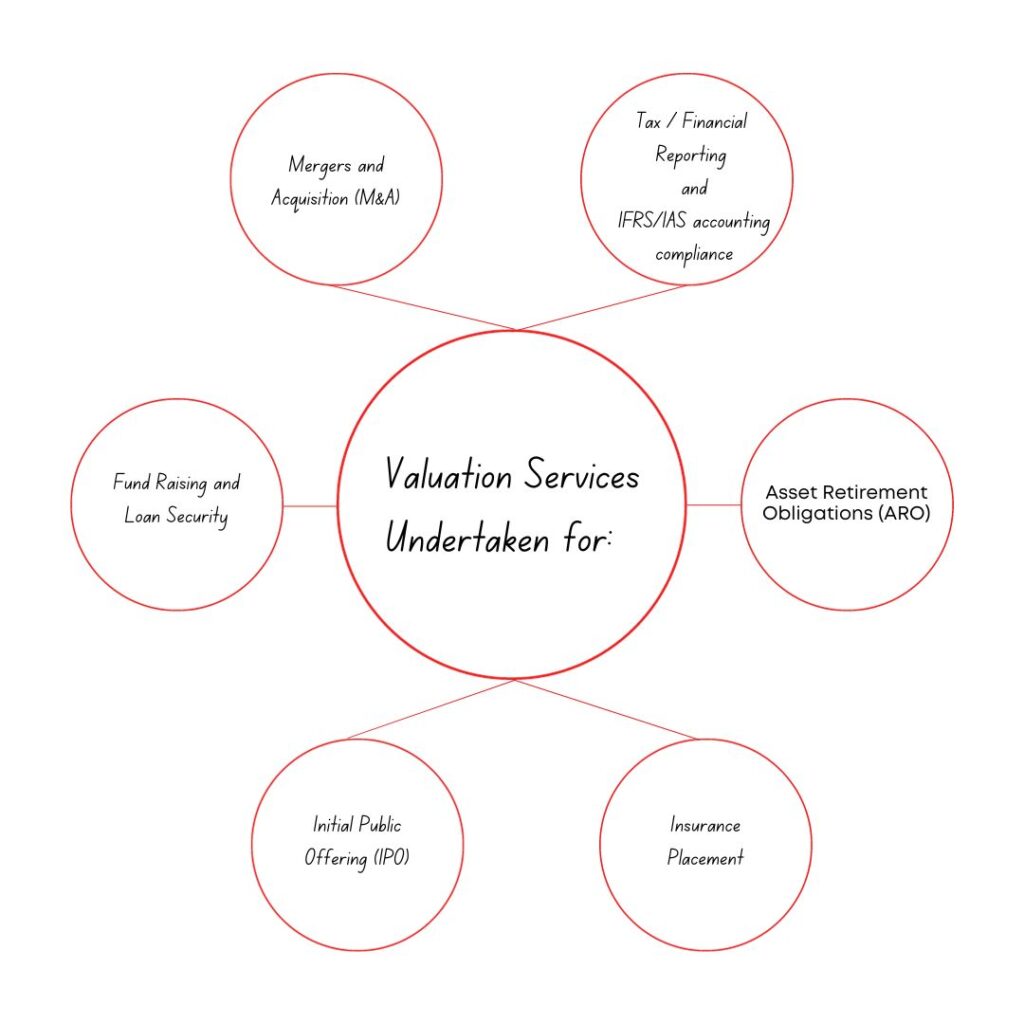

Industrial valuation is determining the fair market value of an industrial asset or business. There are several reasons why businesses and individuals might need to conduct an industrial valuation (in India, dubai), including:

Mergers and Acquisitions (M&A): Making Informed Strategic Decisions

- Accurate Deal Pricing: Valuing your target company or its assets is crucial for negotiating a fair price in M&A deals. An accurate valuation protects you from overpaying or undervaluing the acquisition, ensuring long-term financial stability.

- Synergy Evaluation: Identifying potential synergies between merging companies requires understanding the true value of each entity’s industrial assets. This helps assess cost-saving opportunities, revenue growth potential, and overall deal viability.

- Risk Management: Industrial valuation helps uncover hidden liabilities or potential environmental issues associated with target assets, mitigating unforeseen risks and informing due diligence processes.

IFRS/IAS Compliance: Adherence to Standards for Transparency and Credibility

- IFRS 13 Fair Value Measurement: Complying with this standard requires reliable valuations of your industrial assets for financial reporting purposes. Accurate valuations enhance financial transparency and investor confidence.

- IAS 36 Impairment of Assets: Timely identification of asset impairment through valuation minimizes losses and ensures accurate financial reporting under IAS 36.

- Purchase Price Allocation: Allocating the purchase price of acquired assets to different asset classes is crucial for accurate depreciation and amortization calculations. Industrial valuation provides the basis for fair and compliant allocation.

Beyond M&A and Compliance: Diverse Applications for Robust Business Decisions

- Tax / Financial Reporting: Cost segregation and componentization of assets optimize depreciation deductions and improve tax planning. Fixed asset register creation and verification to ensure accuracy and compliance.

- Insurance Placement: Determining replacement cost helps secure adequate insurance coverage and prevents losses in case of damage or destruction. Desktop updates and industry cost escalation reports keep valuations current for optimal insurance coverage.

- IPO and Fund Raising: Accurate valuations attract investors and enhance confidence in your company’s growth potential during an IPO or loan security negotiations.

- Litigation: Industrial valuations may be needed in litigation cases, such as when there is a dispute over the value of an asset.

- Strategic planning: Businesses may conduct industrial valuations as part of their strategic planning process. For example, a company may need to know the value of its assets to make decisions about whether to expand, invest in new technology, or merge with another company.

- Expert Witness: In legal disputes involving industrial assets, a credible valuation performed by a qualified expert can sway decisions and protect your interests.

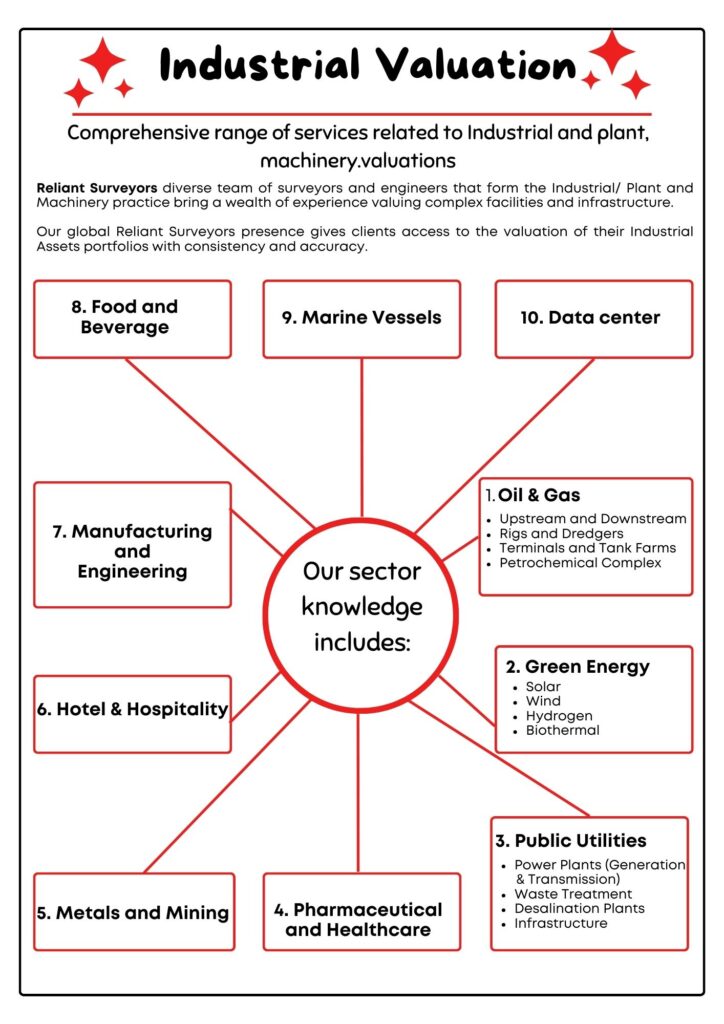

Reliant Surveyor’s Expertise in Industrial Valuation across Diverse Sectors:

Your comprehensive sector knowledge in industrial valuation sets you apart, catering to a wide range of industries with unique asset complexities. Let’s dive deeper into the specific value you bring to each sector:

-

Oil & Gas:

- Upstream Valuation: Expertise in valuing exploration and production assets, including rigs, platforms, and seismic data, ensuring accurate assessment of reserves and future potential.

- Downstream Valuation: Navigating the intricacies of refineries, pipelines, and terminals, considering factors like processing capacity, product mix, and environmental regulations.

- Rigs and Dredgers: Understanding the specialized functionality and depreciation patterns of these critical assets for accurate valuations.

- Terminals and Tank Farms: Assessing the strategic location, storage capacity, and operational efficiency of these crucial storage facilities.

- Petrochemical Complex: Valuing complex integrated operations with interconnected processes, considering feedstock costs, product demand, and technological advancements.

-

Green Energy:

- Solar: Analyzing factors like panel efficiency, irradiation levels, and grid connection for accurate solar farm valuations.

- Wind: Understanding wind resource potential, turbine technology, and operational costs to value wind farms effectively.

- Hydrogen: The emerging potential of hydrogen as a clean fuel requires expertise in valuing production facilities, storage infrastructure, and transportation networks.

- Biothermal: Assessing the viability of biomass-based energy projects, considering feedstock availability, conversion technologies, and market demand.

-

Public Utilities:

- Power Plants: Valuing diverse power generation sources (coal, gas, nuclear, renewable) requires understanding operational efficiency, fuel costs, and regulatory landscape.

- Waste Treatment: Assessing the value of waste treatment facilities considering capacity, treatment technologies, and environmental compliance.

- Desalination Plants: Valuing critical infrastructure for providing clean water, considering water scarcity, production capacity, and energy costs.

- Infrastructure: Expertise in valuing transmission lines, distribution networks, and other vital infrastructure assets.

-

Pharmaceutical and Healthcare:

- Manufacturing Facilities: Understanding specific regulatory requirements, production processes, and intellectual property associated with pharmaceutical and medical device manufacturing.

- Hospitals and Clinics: Valuing healthcare facilities considering patient volume, service scope, equipment, and building infrastructure.

- Research and Development Assets: Assessing the value of intellectual property and ongoing research projects in the pharmaceutical and healthcare sector.

-

Metals and Mining:

- Mines and Mineral Deposits: Valuing mineral reserves, considering geological factors, extraction methods, and processing costs.

- Processing Facilities: Understanding the specific equipment and technologies used in metal refining and production for accurate valuations.

- Transportation Infrastructure: Expertise in valuing conveyors, rail lines, and ports used for transporting mined materials.

-

Hotel & Hospitality:

- Hotels and Resorts: Valuing hospitality assets considering location, brand reputation, amenities, and room occupancy rates.

- Restaurants and Bars: Understanding factors like customer base, menu offerings, and operating costs for accurate restaurant valuations.

- Entertainment Venues: Expertise in valuing casinos, theme parks, and other specialized hospitality assets.

-

Manufacturing and Engineering:

- Factories and Production Lines: Assessing the value of manufacturing facilities considering equipment, production capacity, and operational efficiency.

- Intellectual Property: Valuing patents, trademarks, and other intellectual property associated with manufacturing processes and products.

- Supply Chain and Logistics: Understanding the impact of supply chain efficiency and logistics infrastructure on the value of manufacturing businesses.

-

Food and Beverage:

- Food Processing Plants: Valuing facilities considering food safety regulations, processing technologies, and raw material costs.

- Distribution Networks: Expertise in valuing cold chain infrastructure and logistics systems for food and beverage products.

- Brands and Trademarks: Understanding the value of established brands and trademarks in the food and beverage industry.

-

Marine Vessels:

- Commercial Ships: Valuing various types of vessels like tankers, cargo ships, and cruise ships, considering factors like tonnage, cargo capacity, and operational history.

- Offshore Assets: Expertise in valuing platforms, rigs, and other offshore infrastructure used in oil and gas exploration and production.

- Ports and Shipyards: Understanding the strategic location and operational efficiency of ports and shipyards for accurate valuations.

-

Data Center:

- Server Infrastructure: Valuing data centre equipment, considering processing power, storage capacity, and energy efficiency.

- Connectivity and Security: Understanding the value of network infrastructure, fibre optic cables, and security systems in data centres.

- Market Demand and Location: Assessing the impact of regional demand and data centre location on asset value.

Choose Reliant Surveyors for Industrial Valuation Services

With four decades of experience, Reliant Surveyors specialize in determining the true value of industrial property, equipment, and heavy machinery valuation , ensuring a comprehensive assessment. Our expertise, coupled with market insights and a meticulous approach, facilitates an accurate evaluation of your assets’ worth, empowering well-informed decisions crucial for your business’s trajectory. Whether streamlining financial reporting, securing financing, or managing intricate transactions, rely on Reliant Surveyors as your reliable partners. They adeptly navigate the complexities of industrial valuation, offering unwavering assurance and clarity at every phase.

why reliant Surveyors Stand out Industrial machinery valuation

- Unwavering Expertise: Backed by a team of RICS-qualified and highly experienced professionals, Reliant Surveyors boast a depth of knowledge that puts them at the forefront of the industry. They understand the intricacies of even the most specialized industrial assets, ensuring accurate and informed valuations that you can rely on.

- Market-Savvy Approach: Gone are the days of static valuations. Reliant Surveyors stay ahead of the curve by constantly monitoring market trends, economic fluctuations, and industry-specific factors. This dynamic approach ensures your valuation reflects the true current market value of your assets, safeguarding your financial interests.

- Beyond Numbers: A valuation report from Reliant Surveyors is more than just a numerical figure. It’s a comprehensive analysis that delves into the specific characteristics of your assets, their operational efficiency, and potential future performance. This detailed insight empowers you to make informed decisions with confidence.

- Tailored Solutions: No two industrial operations are exactly alike. Reliant Surveyors understand this fundamental truth and tailor their valuation approach to your specific needs. Whether you’re dealing with a sprawling manufacturing plant, a specialized refinery, or a niche production facility, they have the expertise to deliver a valuation that reflects your unique circumstances.

- Unwavering Integrity: Trust is paramount in the world of valuations. Reliant Surveyors operate with the highest ethical standards, ensuring transparency and objectivity in every project they undertake. You can rest assured that their valuations are not just accurate, but also credible and unbiased.

The seasoned team at Reliant Surveyors brings extensive expertise and knowledge to aid you in plant, machinery valuation, and construction equipment valuation appraisal. Reach out to our proficient experts for swift and dependable industrial machine appraisal and equipment valuation. Our services in valuing Machinery and Equipment Appraisal prioritize delivering equitable quotes. Trust us for professional guidance on plant and machinery valuations in Dubai, UAE, India, and the United Kingdom, including heavy equipment valuation. Stay connected with our team for the utmost reliability in industrial valuation services tailored to your requirements.

Contact Reliant Surveyors today and let their expertise illuminate the true value of your industrial assets:

📧 [email protected] | 📞+971 4554683(Dubai)

📧 [email protected]| 📞 +91 7494999369 (India)

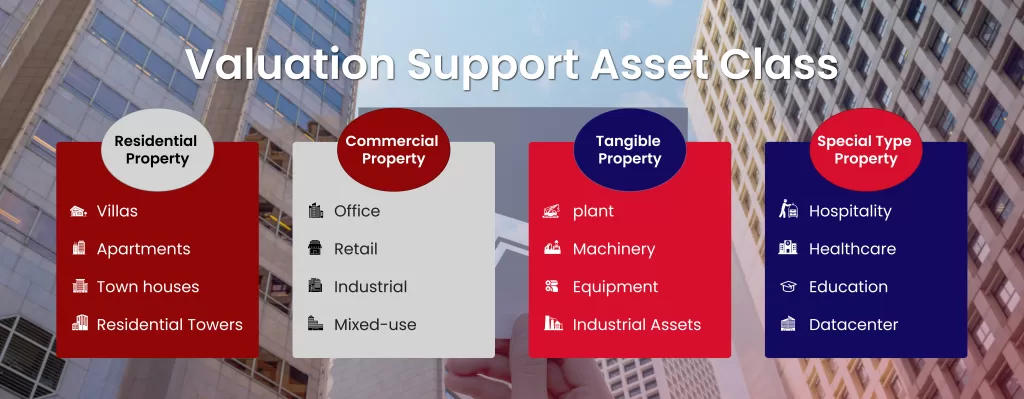

Apart from Industrial valuation, Reliant surveyors do a range of valuation services Incudes: